flow through entity llc

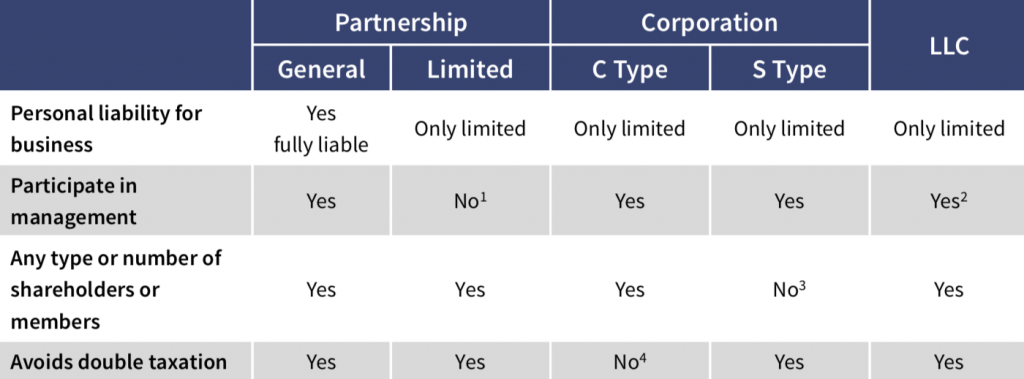

The protection of personal. That is the income of the entity is treated as the income of the investors or owners.

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

As a result only these individualsand not the entity itselfare taxed on the revenues.

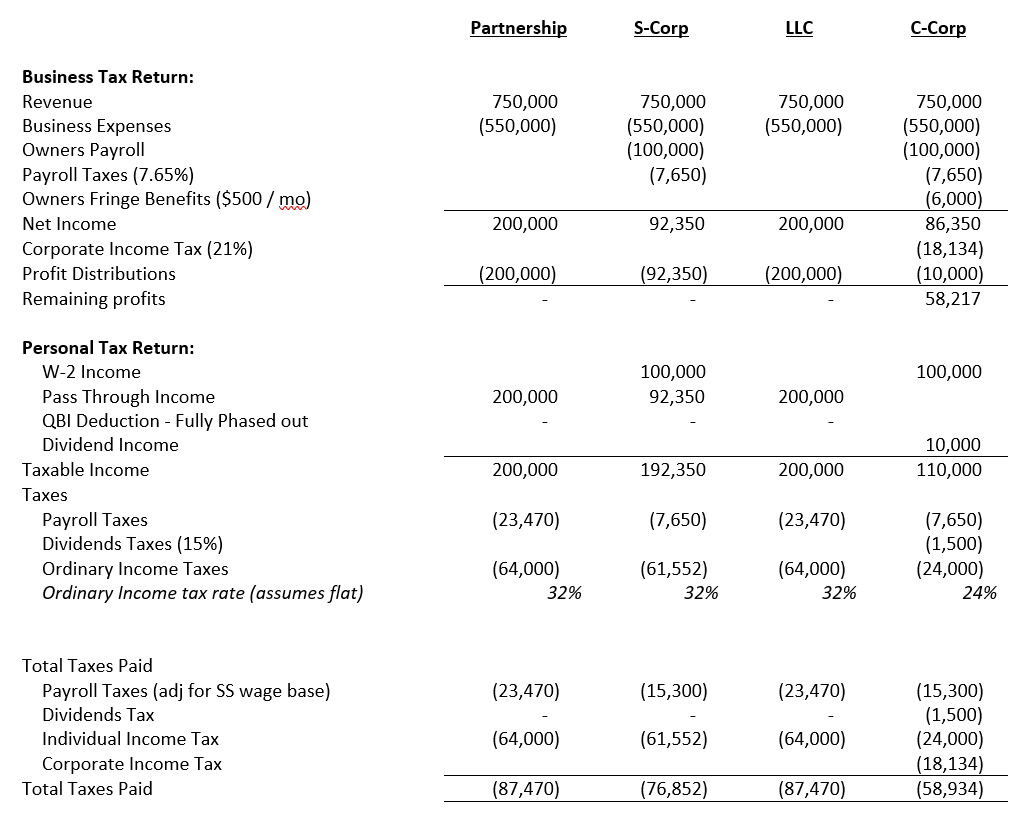

. The most common type of flow-through entity is the partnership. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

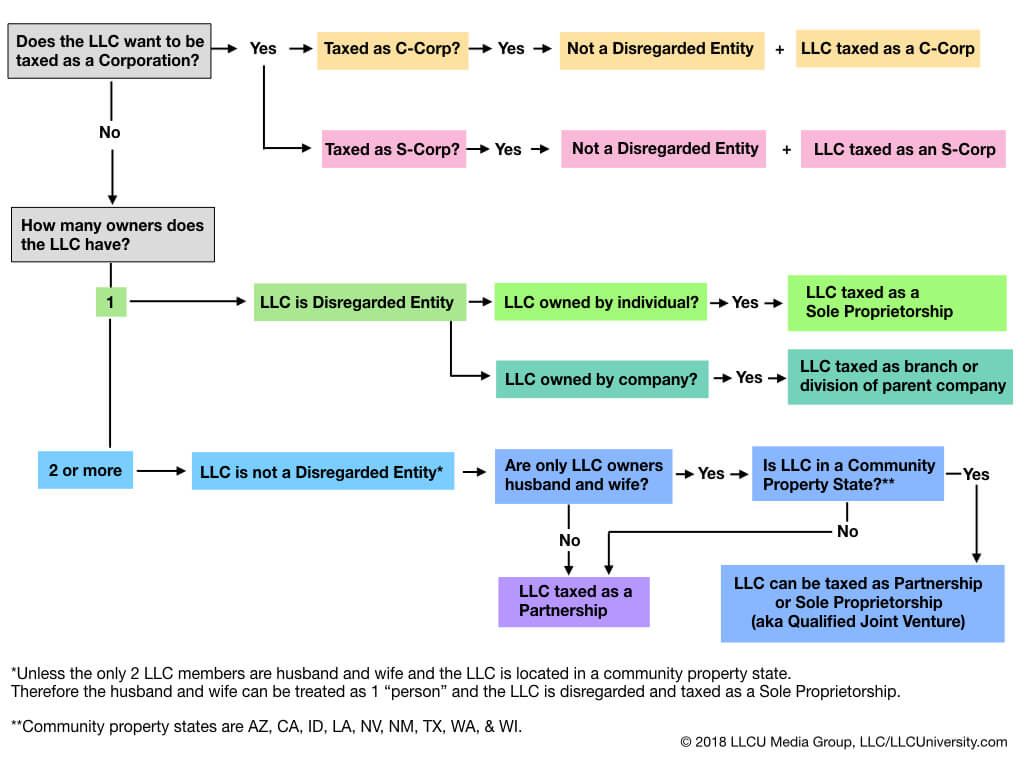

Other types of flow-through entities include S corporations limited liability companies LLCs and real estate investment. Unless the owners of the LLC file paperwork to change the companys tax status the. An LLC can choose between different tax treatments.

A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. This 500 donation will flow through to be included with any other personal charitable donations that Member made in that taxable year and will be jointly subject to any limitation on. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the company level.

Instead their owners include their allocated shares of profits in. Since 95 of businesses are incorporated as. Pass-through entities are also responsible for paying 153 of their profits in employment tax.

A flow-through entity is also called a pass-through entity. Pass-through entity also known as a flow-through entity. Instead that income passes through or flows through to the owners and is.

Pass-through taxation is when a business entity like a Limited Liability Company doesnt pay taxes on business profits directly to the IRS. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity.

By doing so the income is taxed at the individual tax rate for any. This guidance is expected to be published in early January 2022 and will be posted. Flow-through entities are a common device used to avoid double taxation which happens wit See more.

LLC Income Tax Overview. Is an LLC a flow-through entity. Then what is a flow through entity example.

Limited liability companies LLCs are pass-through entities by default. Types of flow-through entities. This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor.

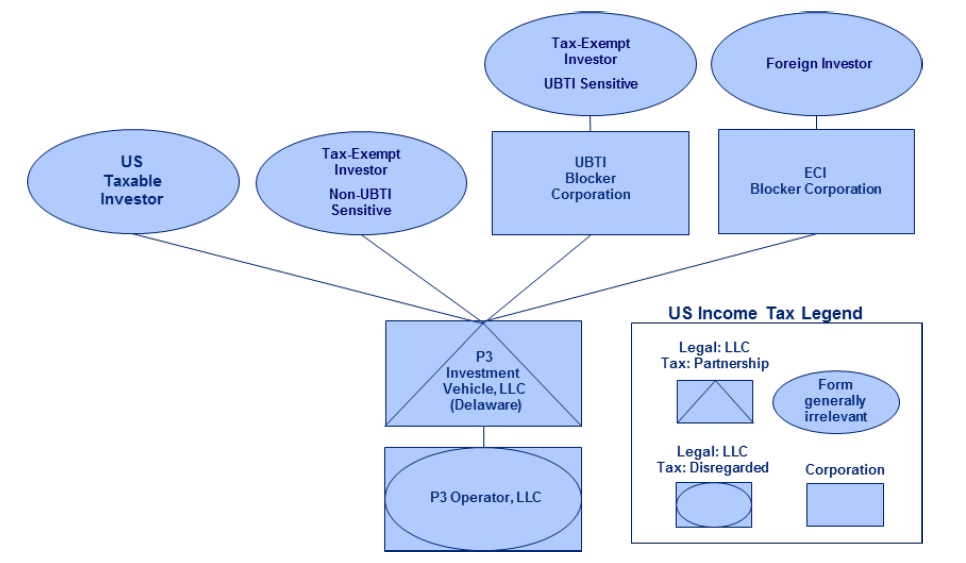

Structuring the Flow-Through Entity. With that said the LLC isnt a separate tax entity. Reasons to Consider Using a Pass-Through Entity.

Therefore LLC owners cant be held personally liable for the debts and obligations of the business. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a corporate tax. A business owned and operated by a single individual.

There are three main types of flow-through entities.

How To Pay Yourself As An Llc Totallegal

Llc Pass Through Entity Ppt Powerpoint Presentation Show Example File Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Fhwa Center For Innovative Finance Support P3 Toolkit Publications

Trends In New Business Entities 30 Years Of Data Legal Entity Management Articles

What Is A Pass Through Entity Youtube

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Entity Explained Perry Associates

Should I Initially Self Fund My Startup As An Llc Rather Than A C Corp To Better Be Able Count Any Losses Against Other Substantial Income Quora

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Publicly Traded Partnerships Tax Treatment Of Investors

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

What Are The Tax Benefits Of An Llc Smartasset

Are You Using The Best Entity Structure For Your Farm Agweb

What Is A Pass Through Business How Is It Taxed Tax Foundation